All Categories

Featured

Table of Contents

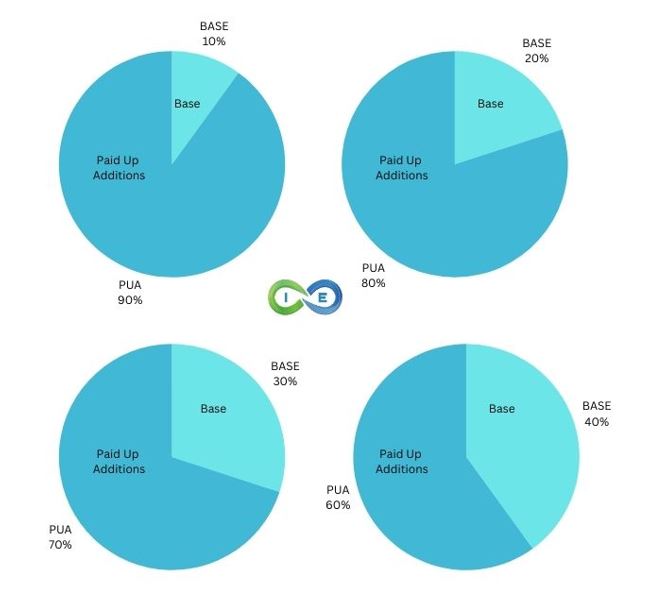

A PUAR enables you to "overfund" your insurance coverage right as much as line of it becoming a Customized Endowment Agreement (MEC). When you utilize a PUAR, you rapidly enhance your cash value (and your fatality benefit), thereby increasing the power of your "financial institution". Better, the even more cash money worth you have, the higher your rate of interest and dividend settlements from your insurance policy company will certainly be.

With the surge of TikTok as an information-sharing system, economic suggestions and methods have discovered a novel way of spreading. One such approach that has actually been making the rounds is the limitless financial concept, or IBC for short, garnering endorsements from celebrities like rapper Waka Flocka Fire. However, while the approach is presently popular, its origins map back to the 1980s when economist Nelson Nash presented it to the world.

What happens if I stop using Infinite Banking Cash Flow?

Within these policies, the cash money value grows based upon a price set by the insurance company (Cash flow banking). Once a significant cash money value gathers, insurance policy holders can get a money worth funding. These car loans differ from standard ones, with life insurance policy acting as collateral, meaning one might shed their insurance coverage if borrowing excessively without ample cash value to support the insurance policy expenses

And while the appeal of these plans appears, there are inherent constraints and risks, requiring diligent cash money value surveillance. The method's authenticity isn't black and white. For high-net-worth individuals or local business owner, particularly those making use of methods like company-owned life insurance policy (COLI), the advantages of tax breaks and compound development can be appealing.

The appeal of limitless financial does not negate its obstacles: Cost: The foundational need, an irreversible life insurance coverage policy, is pricier than its term counterparts. Eligibility: Not everyone gets approved for entire life insurance policy as a result of rigorous underwriting processes that can exclude those with particular health and wellness or way of life conditions. Complexity and danger: The detailed nature of IBC, combined with its dangers, may hinder lots of, specifically when less complex and much less risky alternatives are offered.

Can I use Bank On Yourself to fund large purchases?

Assigning around 10% of your monthly revenue to the policy is simply not practical for a lot of people. Component of what you check out below is just a reiteration of what has currently been stated above.

So prior to you get yourself right into a circumstance you're not prepared for, recognize the complying with initially: Although the concept is commonly marketed as such, you're not in fact taking a loan from on your own. If that were the situation, you would not have to settle it. Rather, you're obtaining from the insurer and need to repay it with passion.

Some social media posts suggest using money worth from entire life insurance policy to pay for bank card debt. The concept is that when you settle the loan with rate of interest, the amount will be sent back to your investments. Unfortunately, that's not exactly how it functions. When you pay back the loan, a part of that passion goes to the insurance policy company.

For the first several years, you'll be paying off the payment. This makes it incredibly difficult for your policy to build up worth during this time. Unless you can manage to pay a couple of to a number of hundred dollars for the next decade or more, IBC will not function for you.

What resources do I need to succeed with Tax-free Income With Infinite Banking?

Not everybody ought to rely only on themselves for economic protection. If you call for life insurance policy, right here are some valuable tips to think about: Take into consideration term life insurance. These plans offer insurance coverage during years with significant economic obligations, like home loans, pupil lendings, or when looking after little ones. Make certain to shop around for the very best price.

Envision never ever having to stress over bank financings or high rate of interest once more. What if you could borrow money on your terms and construct wealth concurrently? That's the power of boundless banking life insurance policy. By leveraging the cash money value of whole life insurance coverage IUL policies, you can expand your wide range and obtain cash without relying upon typical financial institutions.

There's no set loan term, and you have the liberty to pick the repayment timetable, which can be as leisurely as paying back the financing at the time of death. Tax-free income with Infinite Banking. This flexibility encompasses the maintenance of the car loans, where you can go with interest-only payments, maintaining the funding balance level and convenient

Holding money in an IUL fixed account being credited rate of interest can usually be far better than holding the cash on down payment at a bank.: You have actually always imagined opening your own pastry shop. You can borrow from your IUL policy to cover the preliminary expenses of renting out an area, purchasing devices, and employing staff.

What resources do I need to succeed with Infinite Banking Concept?

Individual car loans can be obtained from traditional financial institutions and credit score unions. Obtaining cash on a credit report card is normally extremely costly with yearly percentage rates of passion (APR) commonly reaching 20% to 30% or even more a year.

Latest Posts

Wealth Squad Aloha Mike On X: "Become Your Own Bank With ...

A Beginner's Guide To Starting Your Own Bank

How To Start Your Own Offshore Bank