All Categories

Featured

Table of Contents

A PUAR enables you to "overfund" your insurance plan right as much as line of it becoming a Modified Endowment Contract (MEC). When you use a PUAR, you swiftly increase your money value (and your survivor benefit), thereby enhancing the power of your "bank". Additionally, the even more money value you have, the higher your passion and dividend settlements from your insurance provider will be.

With the rise of TikTok as an information-sharing platform, monetary suggestions and approaches have actually located an unique method of dispersing. One such technique that has actually been making the rounds is the limitless banking concept, or IBC for brief, amassing endorsements from celebs like rap artist Waka Flocka Flame. While the approach is currently prominent, its roots map back to the 1980s when financial expert Nelson Nash introduced it to the globe.

Can I use Leverage Life Insurance to fund large purchases?

Within these policies, the cash money worth expands based on a rate established by the insurance company (Borrowing against cash value). As soon as a substantial cash worth collects, policyholders can get a money value finance. These lendings differ from standard ones, with life insurance acting as security, indicating one can shed their coverage if borrowing exceedingly without adequate cash value to support the insurance policy expenses

And while the allure of these plans appears, there are innate constraints and threats, demanding persistent cash worth surveillance. The approach's legitimacy isn't black and white. For high-net-worth individuals or company owner, specifically those using methods like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and compound development can be appealing.

The appeal of unlimited financial does not negate its difficulties: Expense: The foundational requirement, an irreversible life insurance policy, is more expensive than its term counterparts. Qualification: Not everyone qualifies for whole life insurance policy as a result of rigorous underwriting procedures that can exclude those with certain health and wellness or way of life problems. Complexity and risk: The elaborate nature of IBC, coupled with its risks, may hinder several, especially when less complex and less dangerous alternatives are readily available.

What are the common mistakes people make with Policy Loans?

Alloting around 10% of your month-to-month earnings to the plan is simply not feasible for most people. Part of what you check out below is just a reiteration of what has currently been stated above.

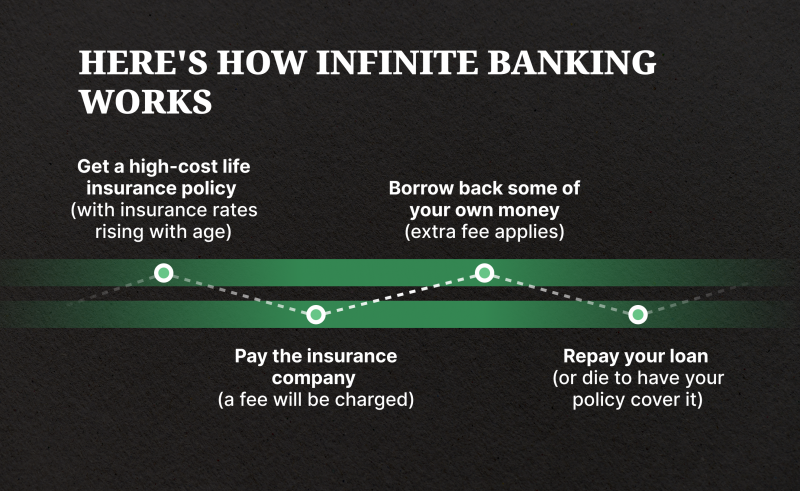

So prior to you get on your own into a circumstance you're not gotten ready for, recognize the following first: Although the concept is frequently sold thus, you're not in fact taking a car loan from yourself. If that were the case, you would not have to repay it. Instead, you're borrowing from the insurer and have to settle it with rate of interest.

Some social media blog posts suggest utilizing money value from entire life insurance policy to pay down bank card financial debt. The idea is that when you repay the loan with passion, the amount will be returned to your investments. Sadly, that's not exactly how it functions. When you pay back the finance, a part of that passion mosts likely to the insurer.

For the first a number of years, you'll be paying off the payment. This makes it incredibly tough for your plan to accumulate worth during this time. Unless you can afford to pay a couple of to a number of hundred bucks for the next decade or more, IBC will not work for you.

How long does it take to see returns from Policy Loans?

Not everybody must rely exclusively on themselves for economic safety. If you need life insurance policy, below are some valuable pointers to take into consideration: Think about term life insurance policy. These plans provide coverage throughout years with considerable financial obligations, like mortgages, student car loans, or when caring for children. Make certain to go shopping about for the very best price.

Think of never ever having to fret about small business loan or high rate of interest again. Suppose you could obtain cash on your terms and construct wealth simultaneously? That's the power of infinite financial life insurance policy. By leveraging the cash money value of entire life insurance policy IUL plans, you can grow your wide range and borrow money without counting on standard banks.

There's no collection loan term, and you have the liberty to make a decision on the settlement timetable, which can be as leisurely as repaying the financing at the time of death. Wealth building with Infinite Banking. This adaptability includes the servicing of the financings, where you can choose interest-only payments, maintaining the funding balance flat and manageable

Holding money in an IUL dealt with account being attributed interest can often be far better than holding the cash money on down payment at a bank.: You have actually always desired for opening your very own pastry shop. You can borrow from your IUL plan to cover the initial expenses of renting out an area, purchasing equipment, and working with staff.

What is the long-term impact of Life Insurance Loans on my financial plan?

Personal car loans can be gotten from standard banks and cooperative credit union. Right here are some essential points to think about. Bank card can supply a flexible method to borrow cash for very temporary periods. Nevertheless, borrowing money on a credit scores card is usually really pricey with annual percentage prices of interest (APR) commonly getting to 20% to 30% or even more a year - Infinite Banking concept.

Latest Posts

Wealth Squad Aloha Mike On X: "Become Your Own Bank With ...

A Beginner's Guide To Starting Your Own Bank

How To Start Your Own Offshore Bank