All Categories

Featured

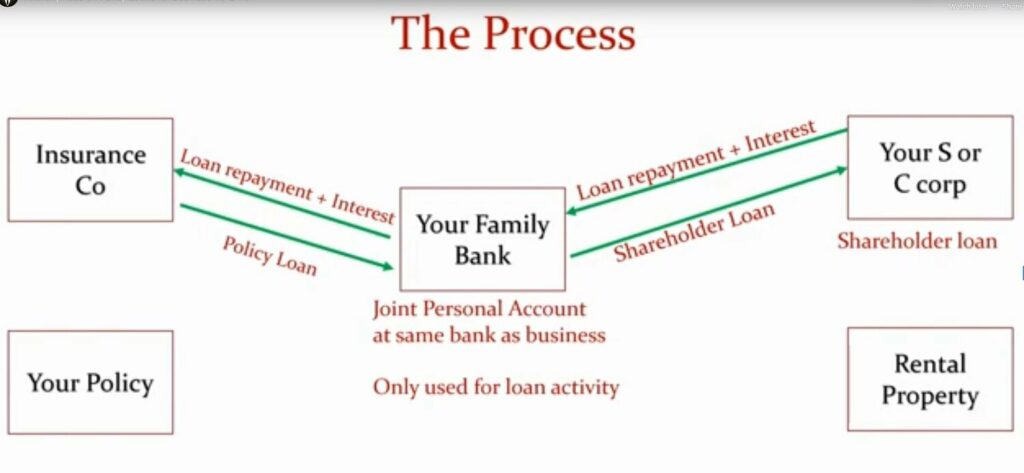

Whole life insurance coverage plans are non-correlated properties - Cash value leveraging. This is why they function so well as the financial structure of Infinite Financial. Despite what happens on the market (supply, realty, or otherwise), your insurance plan retains its worth. A lot of people are missing out on this necessary volatility barrier that assists protect and grow riches, rather splitting their cash into 2 containers: checking account and financial investments.

Market-based investments expand riches much faster however are subjected to market variations, making them inherently dangerous. Entire life insurance coverage is that third pail. Infinite Banking for retirement. Cash flow banking.

Latest Posts

Wealth Squad Aloha Mike On X: "Become Your Own Bank With ...

A Beginner's Guide To Starting Your Own Bank

How To Start Your Own Offshore Bank